If I was to suggest one book that touched on a lot of what I have found to be beneficial in my journey and also had the prescription to help you move past mental barriers, and develop lasting confidence, this would be it. It is a FANTASTIC read that has the power to be a game-changer for you! At the heart of this book is a process that is named the “Rosenberg Reset.” This simple tool is here to ground you in the fact that when difficult emotions arise it is not the emotion itself that we are trying to avoid, but rather the uncomfortable bodily sensations associated with the emotion. The good news is this. That bodily sensation (which we usually feel even before we intellectually connect to the emotion, imagine our body as an early warning system) will usually last 90 seconds or less before the chemicals our body has released to create the sensation are flushed from our body. So in short, if we can recognize a situation where we may be uncomfortable (imagine introducing yourself at a networking event) and realize that we may feel a difficult emotion for 90 seconds at the point we introduce ourselves, and then we will be fine, we can then make the choice to do it, rather than shrinking back in the corner and hiding from discomfort. And here is the magic. The more we connect and ride the wave of these 90-second emotions more and more in our lives, the more we deliberately practice being in these situations ( like networking, engaging in difficult conversations, standing up for ourselves) the more we stretch and grow. The more we can ultimately move towards our full potential rather than sitting back and letting these difficult emotions run our lives.

The reset can be used for multiple situations ranging from helping us stretch and grow as described above to helping us release anxiety, resolving faulty thinking, speaking your truth, and moving through grieving the hand you may have been dealt in the past.

Choose awareness, not avoidance.

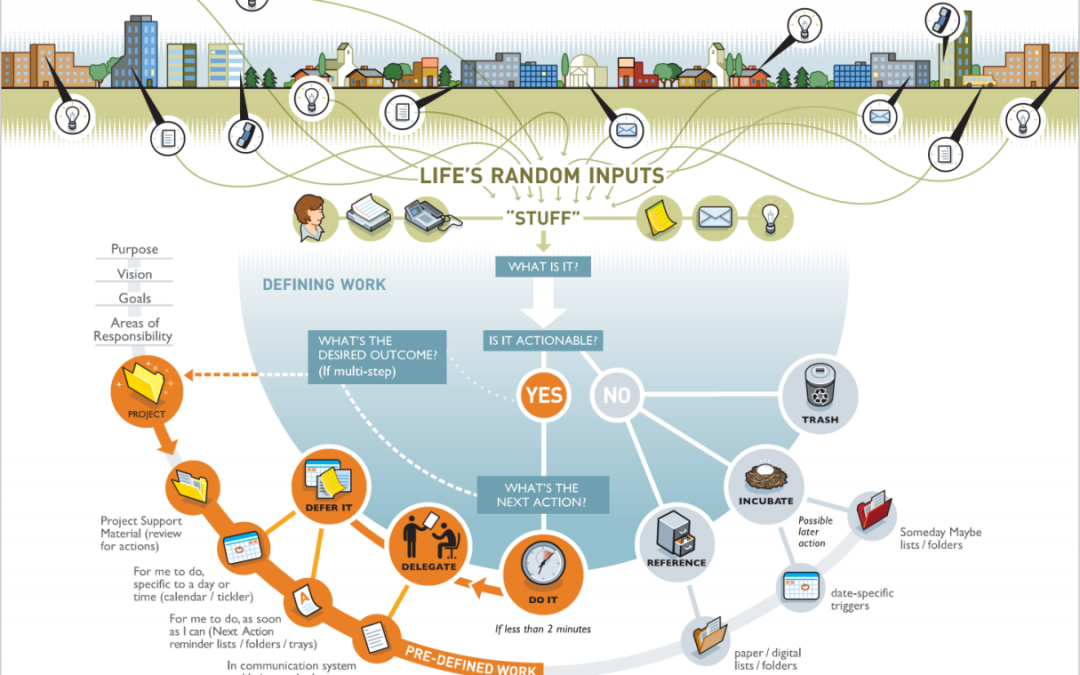

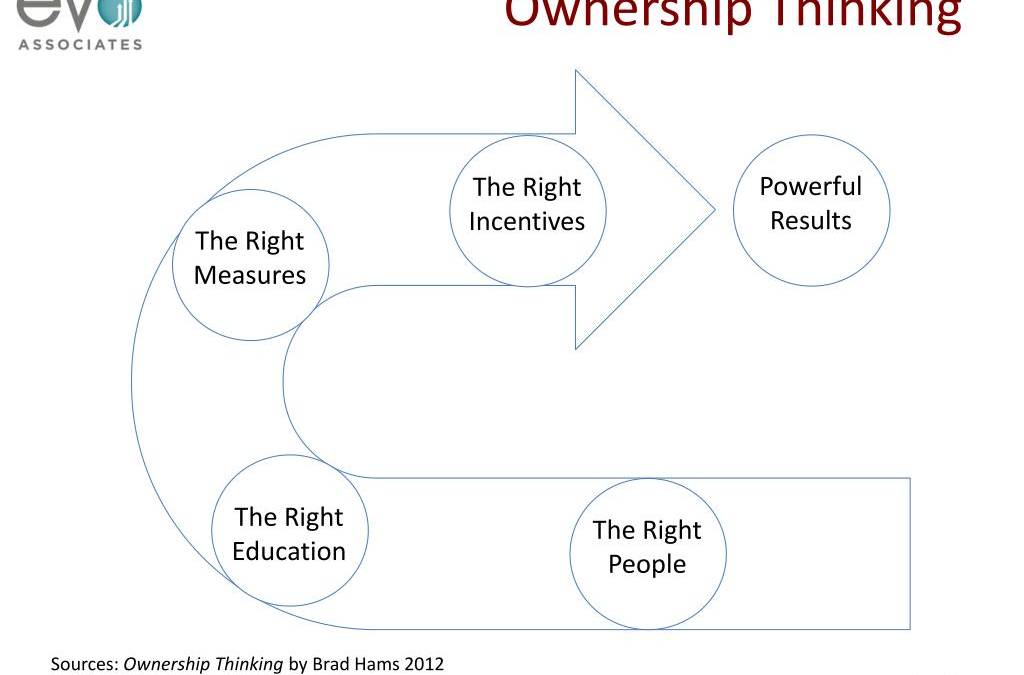

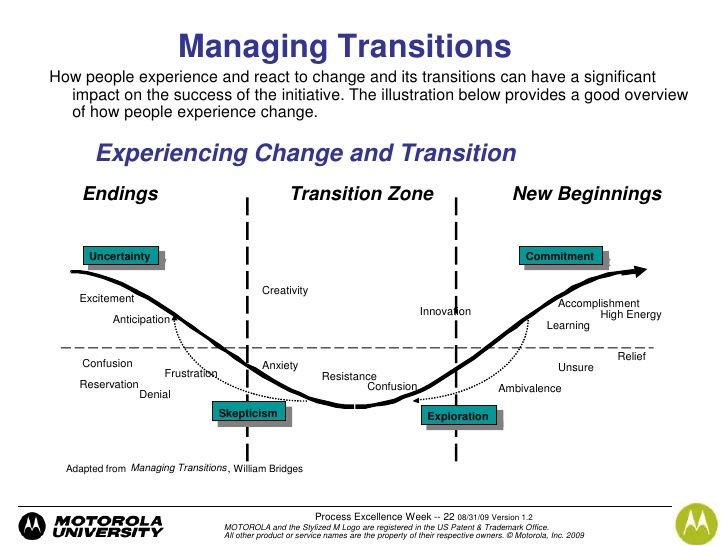

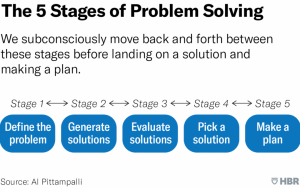

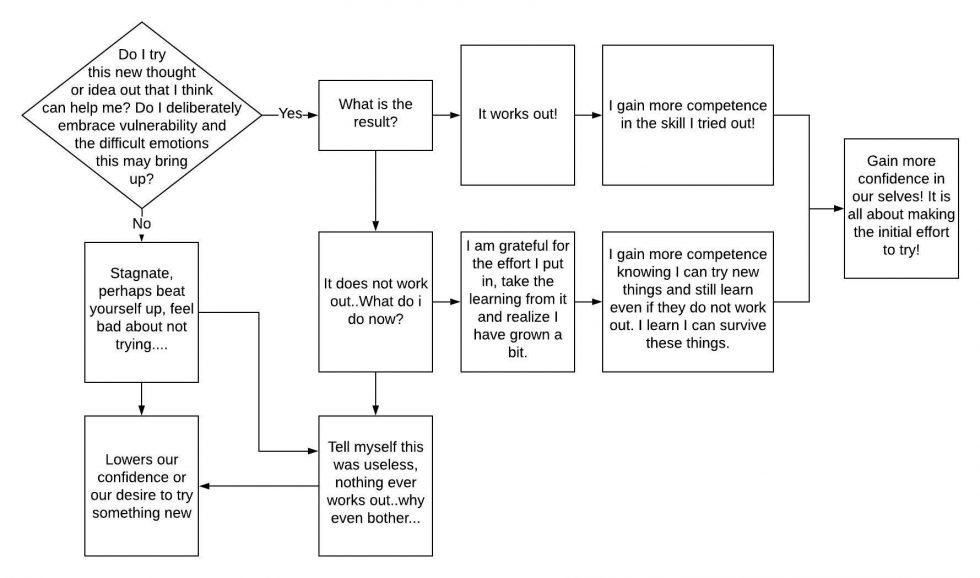

Choose growth, not stagnation- (See a flowchart I put together below showing the choice.

The basic steps to the reset, which are modified for the other aspects noted above are this:

Make a choice to be present with whatever comes up. When you notice an uncomfortable sensation come up in your body it is an early warning that a difficult feeling may be here and realize something is going on. (e.g. for me my chest and neck may feel tight when I introduce myself to someone new- perhaps I am feeling vulnerable and worrying I embarrass myself)

These 8 challenging emotions are at the base of many things we avoid. It is very important to note that these are not negative, and often are there for our own protection. How we deal with them, and what we choose to do with them is within our control once we can bring more awareness to them.

- Sadness- A temporary feeling and the result of a specific moment or experience.

2. Shame- The belief or feeling of being inadequate, defective, flawed or damaged, and often linked with high levels of harsh self-criticism.

3. Helplessness- Tied into feeling small, powerless, and tied to when you feel you cannot make a difference or impact a certain individual, group, event, or situation.

4. Anger- Often exists when you feel you have been wronged.

5. Embarrassment- A feeling we get when we make a mistake or did something that did not go the way we hoped it would have..

6. Disappointment- A feeling we get when our needs, expectations or desires are unmet.

7. Frustration- More intense than disappointment, often around when our fight or flight reaction is triggered. When things are really tense and the situation becomes a bit more escalated we may feel frustrated. An elevated feeling of disappointment is often mixed with a bit of anger.

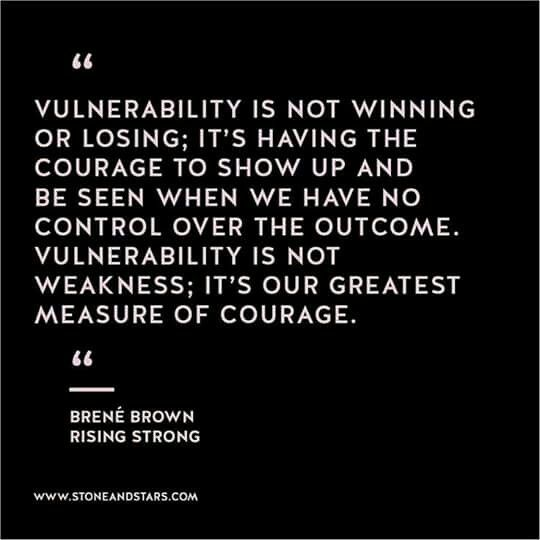

8. Vulnerability- When we feel we may be hurt or put ourselves in a situation that may trigger any of the other 7 emotions above. It will often be present then in situations we think about where we will face difficult emotions. A powerful ally to make ours, and one where making ourselves vulnerable will often allow us the best potential for growth.

When we notice the feeling from one of these emotions be with these feelings for 90 seconds and let it subside and let ourselves become more evenly regulated. If we ride the wave of these emotions for 90 seconds, we can do a lot. We can stretch ourselves beyond what we were able to tolerate before in a tough social situation for example. Calm yourself down if we were feeling angry and be better able to respond rather than react. Or perhaps better see the full situation as it is allowing us to see what it is, we may need to further address to move forward with our lives.

An important note is around a feeling that has been left out for the list above. The feeling of general anxiety. Dr. Rosenberg discusses how anxiety is largely a cover all feeling we have been accustomed to describing. It actually is a coping mechanism that hides what it is we are really feeling. She goes on to describe fear as well. Fear she says is a reaction to an immediate danger. Fear is something that we may need to act on right away. For example the feeling we get when we suddenly remember we left the door wide open after we have left for work. Fear makes us turn around and go home to lock the door. Fear is our internal protection system kicking in. Anxiety is often tied into something we are worrying about from the past, our current situation, or something in the future. It is something that, if we look a bit deeper can often be de-escalated once we know what feeling it is we are actually trying to hide from. Below are the basic steps to the Anxiety Reset from her book:

Identify a specific situation where you felt anxious. Allow yourself to feel this for a moment. Where are you noticing this in your body?

Without using words like anxiety, fear, or worry, which of the 8 feelings (Sadness, shame, helplessness, anger, embarrassment, disappointment, frustration, and vulnerability) best describe what it is you are feeling.

Go back to the experience and swap out the feeling of anxiety for the word or words you came up with above. Stay with it for 5-10 seconds. For example be in that situation and say I am feeling vulnerable and embarrassed.

Can you still feel the feeling of anxiety? What are you noticing in your body? Dr. Rosenberg has found at this point the typical answer is that they can not feel the anxiety anymore. If they still can they may want to further explore if they identified the right underlying feeling.

Did the memory you chose involve other people?

Would have expressing the feeling you identified been appropriate in your situation?

Was this feeling expressed during the situation or soon after?

Oftentimes we do not express what we perhaps could have. This leads to us carrying this excess energy with us building up over time. Going through this exercise allows us to better understand what has been building up as well as helping us see what may be a better way of expressing what we may need to in the future.

Another great concept the book goes on the describe is around how we often hold onto ideas and feelings internally in what she describes as “Disguised Grief”. Dr. Rosenberg notes that as you start to work with the reset in the day to day and become more comfortable with feeling it often unearths deeper help beliefs and feelings. These might appear in your life as blame, bitterness, grudges, leftover anger, or other feelings of long-standing pain. They could be associated with past events and people, things in the now, or things yet to be. Tapping into these feelings (be careful if these feelings are very intense and related to Post Traumatic Stress as this may need more professional help to process, work with or move past) and, moving past, them, and even learning from them can be quite freeing. Below is a pneumonic (GRIEF) from the book to give you a glimpse into what this fantastic chapter explores.

- G- Let your genuine feelings be present and GRIEVE over:

What you got and did not deserve (The bad stuff- abuse, chaos, inconsistency, neglect)

What you deserved but did not get (the good stuff- acknowledgement, praise support)

What never was (the facts, circumstances, and missed opportunities of life)

What is not now (The facts and circumstances of your life right now)

What may never be (Accepting that certain changes or responses may never come)

2. R- REFLECT by identifying an important or high-impact memory or grief to resolve

3. I: INQUIRE MORE DEEPLY. Make sense of your life history by understanding the impact, influence, importance, meaning, relevance, and/or significance of your experience across time.

Who did you become because of the experiences at the time of the event? / in childhood? / in teen years? / in adulthood? / Now?

How did the experience shape you and your outlook, beliefs, or personality?

4. E: Explore and Extract the positive learnings.

5. F: Free yourself. Let go of the “old story” you have described about yourself.

Forgive others and yourself for what they/you did or did not know, or did or did not do.

Forge new images of who you want to become and start living that new story.

The last key thing I will point out, and perhaps the most immediately applicable points of the book, is from another must read chapter about resilience and building confidence. Here are 6 key points that will allow you to, over time, develop a deeper capacity to believe in yourself.

Find ways to experience encouragement and reinforcement regarding how you are valued by others. Surround yourself with people who care for you and that will push you when you need, but also value you for who you are.

Work towards mastering a body of knowledge or developing knowledgeable expertise in something in your life. Find things to be passionate about and to learn throughout your life. It can be part of your work or part of any other aspect of yourself that makes you who you are.

Be present to as much of your moment to moment experience as possible.

Express yourself to others. Express your thoughts, your feelings and what is important to you.

Take action. Do the work. Put in the effort and take steps towards being the best you can right now.

Embrace and take to heart the compliments others pay to you. Allow yourself to feel and adopt these compliments to heart. You are appreciated and valued.

Overall, this book provides what I consider to be an excellent introduction to ways that can help us become aware of, and then move past faulty thinking patterns many have long struggled with. A great read with many tools well worth implementing in your life. A life you can love!

.

Ever heard that what may trigger us and make us uncomfortable may be a clue as to something we need to make peace with ourselves?

Ever heard that what may trigger us and make us uncomfortable may be a clue as to something we need to make peace with ourselves?